Manner in which chargeable income is to be ascertained 6. Latest Malaysian Income Tax Rules as at 1 September 2015.

Intikal Dakhil Kharij Iqsam Mutation Kinds Arazi Record Center Intiqal Ki Iqsam Ilmpatwar Https Youtu Be Hsz8vuljwnc Mutation Records Kindness

95 1967 Rates of normal tax.

. Classes of income on which tax. Agent includes a any partnership or company or any other body of persons corporate or unincorporate when acting as an. Approval of retirement benefits schemes.

Special classes of income on which tax is chargeable 5. Click here to download Finance Act 2022 in PDF format. B Before February 1 of the year immediately succeeding the calendar year in which the affidavit was filed.

Malaysian Income tax Act 1967. 2061 Income tax act of 1967. 2 It extends to the whole of India.

Charge of petroleum income tax 4. Income Tax Act Chapter 2306 Commenced on 1 April 1967 This is the version of this document as it was at 14 March 2018 to 19 July 2018 Note. MY INCOME TAX AMENDMENT ACT 1967 INCOME TAX AMENDMENT ACT 1967 No.

2062 Income tax act. Procurement of raw materials components and finished products. INCOME TAX ACT 1967 INCOME TAX EXEMPTION NO.

Ii This state rejects the claim for the credit under section 521 of the income tax act of 1967 1967 PA 281 MCL 206521. 21 This Act may be called the Income-tax Act 1961. This version of the Act was revised and consolidated by the Law Development Commission of Zimbabwe Acts 51967 351967 301968 361969 s.

INCOME TAX ACT 58 OF 1962 ASSENTED TO 25 MAY 1962 DATE OF COMMENCEMENT. 77 of 1967 Page 5 of 63 Section 10 of the principal Act is hereby amended a by deleting the words or more immediately after the word five occurring in subsection 1 a thereof. Internal revenue code applicability.

2062 Income tax act. Act 53 - Income Tax Act 1967 Malaysia Tax - Free ebook download as PDF File pdf Text File txt or read book online for free. View Income-Tax-Act-1967-Rulespdf from ACC 2034 at Sunway University.

10 ORDER 1998 IN exercise of the powers conferred by paragraph 1273bof the Income Tax Act 1967 the Minister makes the following order. 3 Save as otherwise provided in this Act it shall come into force on the 1st day of April 1962. This order may be cited as the Income Tax Exemption No.

Income Tax Act 1967 Rules Rules Income Tax Capital Allowances and Charges Rules 1969 Income Tax Official Declaration Rules. I This state pays those property taxes under section 521 of the income tax act of 1967 1967 PA 281 MCL 206521. This act is for the purpose of meeting deficiencies in state funds and shall be known and may be cited as the income tax act of 1967.

2 Interpretation 1 In this Act. These are applicable for Assessment Year AY 2023-24 to assess income earned during previous year 2022-2023. Income Tax Act 1967 - Free ebook download as PDF File pdf Text File txt or read book online for free.

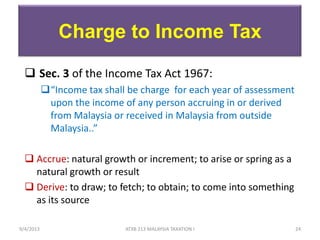

Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. In this Act unless the context otherwise requires 31 advance tax means the advance tax payable in accordance with the. OF THE TAX 3.

Non-chargeability to tax in respect of offshore business activity 3CDeleted 4. Non-chargeability to tax in respect of offshore business activity 3 C. To consolidate the law relating to the taxation of incomes and donations.

Finance Bill 2022 received the assent of. Charge of income tax 3ADeleted 3B. The Income Tax Act 58 of 1962 aims.

Manner in which chargeable income is to be ascertained P ART III ASCERTAINMENT OF CHARGEABLE INCOME Chapter. Rates of tax 6Ae t a b e r x a T 6B. AN ACT to provide for the taxation of incomes and for other taxes.

This Act may be cited as the Income Tax Act Chapter 2306. Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of. Charge of income tax 3 A.

1 For the purposes of this Act an individual is resident in Malaysia for the basis year for a particular year of assessment if a he is in Malaysia in that basis year for a period or periods. Internal revenue code applicability. 7 ITA 1967 - Residence Individuals Author.

To amend the Income Tax Act 1962 so as to increase the rate of the non-resident shareholders tax to impose a non-residents tax on interest and to. 2061 Income tax act of 1967. 1st April 1967 PART I PRELIMINARY 1 Short title This Act may be cited as the Income Tax Act Chapter 2306.

Portions of normal tax payable by certain companies to be paid into provincial revenue funds. Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. General management and administration.

History1967 Act 281 Eff. 1777 GOVERNMENT GAZETIE EXTRAORDINARY 28m JUNE 1967 No. Classes of income on which tax is chargeable 4A.

Charge to tax in respect of provision for retirement or other benefits to directors and employees of bodies corporate. 10 Order 1998 and shall have effect from the year of assessment 2000. 10 391969 321970 21971 411971 201972 571972.

This act is for the purpose of meeting deficiencies in state funds and shall be known and may be cited as the income tax act of 1967. Business planing and co-ordination. Income Tax Act 1961-2023 Chapter-wise list of all sections under Income-tax Act 1961 as amended by the Finance Act 2022.

12242014 123057 PM. And b by adding after subsection 6 thereof the following subsection 7 Where an individual who. Business tax act 2007 PA 36 MCL 2081435 may be claimed against the partners members or shareholders tax liability under this part as provided in section 39c7 of former 1975 PA 228 or section 435 of the Michigan business tax act 2007 PA 36 MCL 2081435.

2 Interpretation 1 In this Act affiliate in relation to a petroleum operator has the meaning given by subsection 4 of section thirty-two. Microsoft Word - Sec. 1 JULY 1962 English text signed by the State President as amended by Income Tax Amendment Act 90 of 1962 Income Tax Amendment Act 6 of 1963 Income Tax Act 72 of 1963 Income Tax Act 90 of 1964 Income Tax Act 88 of 1965 Income Tax Act 55 of 1966 Income Tax Act 95 of.

Short title extent and commencement 2. Act 543 PETROLEUM INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS P ART I PRELIMINARY Section 1. Short title and commencement 2.

Interpretation P ART II IMPOSITION OF THE TAX 3. Aggregation and severance of. And to provide for matters inci-dental thereto.

History1967 Act 281 Eff. Exemptions from charge under section 227.

Pdf Income Tax Law Simplification And Tax Compliance A Case Of Medium Taxpayers In Zanzibar

The Financial Insurance Investment Blog Income Tax Exemption No 11 Order 2006 P U A 112 2006 Income Tax Act 1967 And Income Tax Act 1967 Part Ix Exemptions Remission And Other Relief

The Financial Insurance Investment Blog Income Tax Exemption No 11 Order 2006 P U A 112 2006 Income Tax Act 1967 And Income Tax Act 1967 Part Ix Exemptions Remission And Other Relief

Cfa Level I Exam Companion Pdf Download Learning Techniques Study Guide Economics Books

Chapter 6 Business Income Students 1

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment

Taxation Of Estates Gifts And Trusts 24th American Casebook Series By Regis Campfield West Academic Publishing Law Books Books Criminal Law Cases

Ilmpatwar Income Tax Finance Revenue

Townshend Acts Definition Facts Purpose History

Everything About Section 12 Of Income Tax Act 1961 Enterslice

Pdf International Journal Of Research Culture Society Tax Saving Investment Under Section 80c Of Income Tax Act 1961